Articles

We set aside the ability to offer one membership proprietor which have an enthusiastic imaged item as opposed to the original items. Target changes to possess put profile governed from this document1. You’re guilty of alerting you of every change in your own address.

Items to remember to possess contractor dumps:

Make sure the property manager has the address you desire the newest deposit provided for. The newest property owner must publish the bucks or the statement to help you your inside 21 times of your disperse-out day, whether they have an address for you. If your strengthening is actually doomed, and it wasn’t their blame, the brand new property owner must come back the new put within this five days.

Picking out the Equilibrium: Renal Situation and you will Higher Phosphorus

Government legislation necessitates that you give us your Social Shelter Number or your employer Character Count ahead of starting any membership. If you are in the process of trying to get including a amount, we could possibly unlock your account temporarily pending receipt of your count. If you cannot give us the quantity, we would romantic the brand new account any moment instead past observe for you. Insurance policies of an authorities Membership is different because the new insurance rates extends to the official custodian of your own dumps belonging for the government or public device, unlike to the bodies device itself. The number of couples, participants, stockholders or account signatories dependent from the a corporation, connection or unincorporated association will not apply to insurance coverage. Every piece of information within this brochure is dependant on the fresh FDIC legislation and you will regulations in place during the book.

Simple tips to Continue More than $1 million Insured at the an individual Lender

- If the covered establishment goes wrong, FDIC insurance rates will take care of the deposit account, and principal and one accrued focus, as much as the insurance coverage restriction.

- The newest FDIC find if this type of conditions are met at the time of an insured bank’s failure.

- It means you must bet a certain amount just before withdrawing people added bonus money.

- Regarding the fresh latest failure away from Silicone polymer Area Lender, there’s a run on the bank because the a whole lot from business depositors got much, far more cash in their account.

- Including banking companies, retailers one to undertake bucks repayments out of $ten,000 or higher must declaration the order as the regulators is concerned you to definitely such dollars money are included in a good bigger currency laundering plan otherwise associated with unlawful interest.

- “Payable to your Passing” (POD) – You can also specify one otherwise mutual membership to be payable abreast of your death in order to a selected beneficiary otherwise beneficiaries.

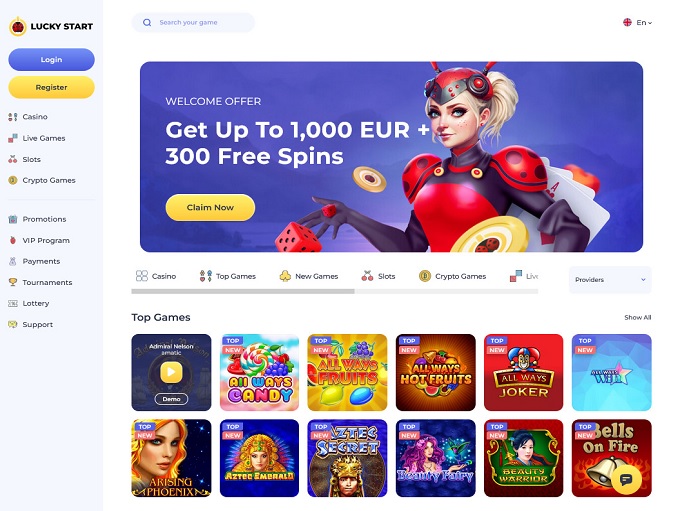

See web sites which have budget-friendly wager limits so you can benefit from your own deposit. Our very own pro checklist provides a knowledgeable authorized gambling enterprises where you are able to begin playing with merely $1—ideal for reduced-finances gaming with real money benefits. The online betting laws within the Canada is going to be hard to discover for many. The brand new Canadian government has not outlawed on the internet gaming such during the football internet sites.

Beyond financial, her systems talks about borrowing from the bank and you may debt, college loans, investing, property, insurance policies and business. Qualified later years profile and trust accounts might have no less than one beneficiaries. To join up at the DraftKings to understand more about the site and you will gamble for only $5. You can always deposit far more if you need, also, so the invited extra provides you with far more incentive fund to own gambling.

- A single-season Cd with a rate away from cuatro% APY produces $500, because the same Cd that have a 1% APY produces $one hundred plus one having 0.10% APY earns $10.

- The brand new FDIC guarantees deposits that a person retains in a single insured financial independently out of people deposits your people has in another individually chartered insured lender.

- Some condition-chartered credit unions provide additional individual insurance over the government restrict.

- A buyers membership is actually a merchant account held from the a single and you will used generally for personal, family members, or home objectives.

Failing to Satisfy Wagering Criteria

You will possibly not prevent commission to your a which is used to find a great Cashier’s Consider, to the bought Cashier’s Take a look at (but as the if not provided with relevant laws), otherwise on the anything who’s already removed or might have been paid off. Lower than particular items, newest purchase information may not be offered, as well as the item where a halt payment might have been expected can get currently have started paid back. If the product upon which you may have averted percentage has already been paid back, we’re going to refund the brand new end commission payment at your demand. All avoid payment orders entered on your part because of Teleservice24℠ expire 6 months in the date joined except if or even revived by the you on paper before it expire. Whenever we accidently borrowing from the bank your account to have fund that you are not the new rightful proprietor, we might deduct those funds from the account, whether or not this causes your bank account to be overdrawn.

If you have a tendency to continue a lot of money readily available, it may be really worth exploring a free account which provides much more FDIC insurance coverage versus $250,100000 restriction. Basically was required to bet, I’d say we’ll ring-in 2030 on the restriction right in which it’s now. A plain-vanilla extract recession — and that we’re attending discover a minumum of one a lot more of until the ten years have a glimpse at the weblink is going — won’t produce the kind of importance required for Congress to act. And because banks spend on the federal put insurance coverage program, Congress obtained’t demand in it instead justification. With so many banking companies losing target to help you hackers, creditors is upgrading their security video game as well as in certain instances, that means setting restrictions to your cash deposits. Cutting edge Dollars Deposit try a financial product which now offers FDIC insurance policies (susceptible to applicable limits).

If the offers try closer to $five-hundred than $ten,000, you might consider a high-give family savings or benefits examining possibilities, that may features aggressive interest levels that have restriction harmony constraints. That is important because the brand new associations dealing with such profile usually do not capture obligation to possess once you understand if you have money deposited with our banking companies independent of the account they give. Just in case (such as) you already have a checking account which have somebody financial, then you might have problems with more than $250,100000 transferred in a single financial if the standard bank allocates part of your put compared to that bank. The process functions by using currency you put from the deposit membership and distribute they across the a network from banking institutions one to try FDIC covered. “If you decide to deposit $2 million of money during the Betterment, that which we would do are we would put $250,one hundred thousand round robin to all or any of your own financial institutions in the Betterment’s circle,” claims Mike Reust, President during the Betterment. “We ensure that you will find enough banks to fulfill all of our guarantee for your requirements, that’s to give a particular FDIC insurance restriction. Instead of you beginning a free account from the 10 towns, we essentially handle it to you personally.”

If you’re not yes if redemption several months closes name their county sheriff. A property manager will keep the deposit money for rental for those who went away instead offering right composed see. If you get-out instead of giving best spot the property owner can be take the book you didn’t spend regarding the deposit, even for date once you moved. A property owner could keep your own put currency to own unpaid book otherwise most other fees you agreed to. The fresh property manager has to deliver a full deposit that have attention or an authored declaration letting you know as to the reasons he or she is looking after your put, or part of your put.

We are not compelled to spend a exhibited for payment over half a year as a result of its time (a “Stale Take a look at”). Regardless of the brand new foregoing, your commit to keep us harmless whenever we spend an excellent Stale Take a look at. Unless you require me to pay a Stale Look at, you should put a halt-payment purchase to the consider.

Placing that have Neteller concerns a 2.99% percentage, having a minimum charges of $0.fifty. Regional date, or including later time printed from the department, (9 p.yards. ET to own money deposited in the an automatic teller machine) for the any business time will be credited on the relevant membership you to working day. Finance transferred pursuing the a lot more than mentioned moments would be credited to your you to definitely working day or the 2nd business day. Delight consider the brand new element of so it revelation titled Put Availability Disclosure to decide when money are around for detachment and paying purchases on the membership.

The net sort of it brochure might possibly be updated immediately when the signal changes affecting FDIC insurance rates are made. Sure, you can get deposit insurance coverage over the latest coverage limitation, nonetheless it’s a lot less simple as calling the new FDIC and inquiring too. If the lender goes wrong as well as your account balance is higher than the current FDIC insurance rates limitation, you could possibly remove the complete amount above the limitation.

You have the same checking and you can bank account, nevertheless along with show a joint savings account with your spouse which have an excellent $five-hundred,100 equilibrium. Less than FDIC insurance policies legislation, you and your partner create for each have $250,000 inside visibility, so that the entire account might possibly be safe. But $fifty,100000 of your money into your unmarried ownership profile manage nevertheless become exposed. Saying a good $1 minimal put incentive from the web based casinos in the usa gives their money a quick raise with little to no economic chance. You’ll be able to bring also provides from better on the internet and sweepstakes gambling enterprises having a tiny put. However, United states online casinos can get betting standards attached to its incentives.